Understanding the EU Carbon Border Adjustment Mechanism (CBAM)

PSA BDP

As the European Union advances towards its ambitious climate goals, the Carbon Border Adjustment Mechanism (CBAM) has emerged as a key policy to curb carbon leakage and promote a level playing field for businesses within and outside the EU. CBAM is designed to address the environmental impact of imported goods, ensuring that industries within the EU do not face unfair competition from countries with lower climate standards. Here’s a closer look at how CBAM works, key milestones, and what EU importers need to do to prepare:

What is CBAM and How Does It Work?

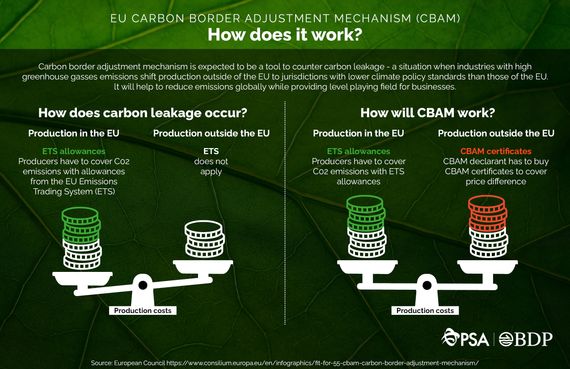

The core idea behind CBAM is to prevent "carbon leakage," — a situation in which industries with high emissions relocate to countries with looser climate policies, undermining EU efforts to reduce greenhouse gases. CBAM will impose a carbon price on imports of certain goods, ensuring that imported products face similar costs for carbon emissions as goods produced within the EU.

How Will CBAM Work?

CBAM introduces a system of carbon certificates for EU importers. Goods produced in the EU are already subject to the EU Emissions Trading System (ETS), which requires producers to cover their CO₂ emissions. CBAM extends a similar requirement to imported goods, where importers will need to purchase CBAM certificates based on the emissions embedded in their products. If the production country already has a carbon price, the corresponding amount will be deducted, creating a fair playing field for all producers.

Key Milestones and Timeline

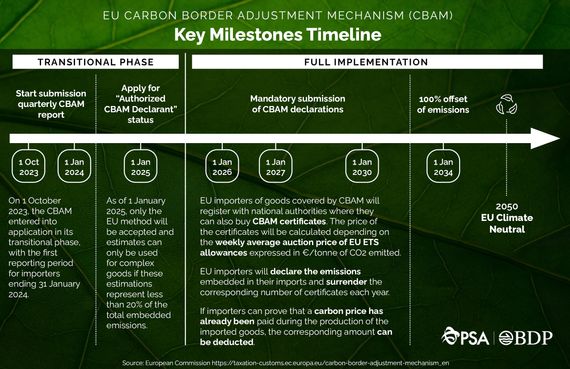

CBAM is being implemented in phases to allow businesses to adapt and ensure a smooth transition. Here’s a timeline of the critical milestones:

-

1 October 2023: CBAM entered its transitional phase, with the first reporting period for importers ending on 31 January 2024.

-

1 January 2024: Importers will need to start submitting quarterly CBAM reports.

-

1 January 2025: Only the EU-approved method for estimating emissions will be accepted, and the threshold for using estimates is set at 20% of total emissions.

-

1 January 2026: Importers must register with national authorities to purchase CBAM certificates, with the price based on the weekly average auction price of EU ETS allowances.

-

1 January 2034: By this date, the goal is to achieve a 100% offset of emissions.

The full implementation of CBAM will ultimately contribute to the EU's goal of climate neutrality by 2050.

Checklist for EU Importers: 5 Steps to Prepare

To ensure compliance with CBAM, EU importers need to follow specific steps as laid out by the European Commission:

-

Check if Your Goods are Covered: Refer to Annex I of the CBAM Regulation and contact your National CBAM Competent Authority (NCA) if needed.

-

Register with NCA: Register with your NCA to upload quarterly emissions reports.

-

Communicate with Trading Partners: Ensure that your trading partners outside the EU understand the CBAM requirements and how to calculate embedded emissions.

-

Follow Available Training: Access training materials from the European Commission to stay informed about reporting and regulatory tools.

-

Submit Reports: Ensure you submit your first CBAM report by the deadline, covering imports from Q4 2023, and stay updated on further requirements.

Preparing for CBAM’s full implementation requires proactive communication with partners and thorough knowledge of emissions tracking.

CBAM is more than just a regulatory measure; it is a step towards a more sustainable global economy. By implementing CBAM, the EU is taking a stand against carbon leakage, promoting fair competition, and paving the way for greener production practices worldwide. As CBAM continues to roll out, it is essential for EU importers to understand their obligations and work closely with their trading partners to meet compliance requirements.

For more detailed guidance, visit the official European Commission page on CBAM here.