With broad sector appeal, the First Sale rule offers reduced Customs duties

Straight from the source. That’s a term we like to see when purchasing our bottled water, or something we seek to hear from our server during that farm-to-table dining experience. Yet when it comes to importers, the First Sale rule can have a much larger impact than the feel-good appeal of locally sourced kale. It can mean a huge financial saving for retail supply chain importers if they go straight to the source, or manufacturer of goods, to buy directly and invoke the First Sale rule.

The First Sale Rule is one which allows importers to use the price paid in the first, or earlier sale, as the basis for customs duty to be paid. Many importers purchase at the second sale, from a middleman vendor who serves as the go-between from the manufacturer to the importer. This second sale is a marked up price. Paying duties on a lesser, first sale price, presents a tremendous savings opportunity, not only for the textiles and footwear supply chain industries where apparel and sneakers are subject to higher duty rates but also for manufacturing, electrical equipment, machinery, food and agriculture, and others. The bottom line, if you are purchasing from a trading company or sourcing agent, there may likely be an opportunity to take advantage of first sale pricing.

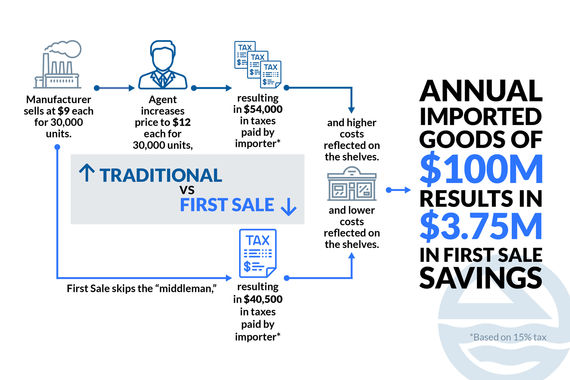

To review example savings, let’s say a company purchases an item from a middleman at $12 per unit, yet the original purchase price from the manufacturer is $9. While duty rates upwards of 25% can be attributed to the apparel world, let’s assume a conservative duty rate of 15%. If importing 30,000 units at the second sale price of $12, the importer is paying duties of $54,000. However, if the importer purchases the goods at the first sale of $9, the duties paid are reduced to $40,500, a savings of $13,500, or 25%. Across $100 million in annual purchased goods, the first sale duty reduction of 25% translates to a savings of $3.75M.

To get started with, and execute, the First Sale rule, an importer must ensure all the proper checks and proof are in place for Customs approval. Implementation requires adherence to the stringent guidelines laid out by Customs, as well as a certainty and trust with the direct manufacturer, who will ultimately be revealing their manufactured cost. Playing a heavy role in implementation is sound documentation of the bona fide sale, which is enabled through verifiable electronic communications of sales contracts, purchase orders, shipping contracts, payments, and/or proofs of purchase. It is imperative to have full tracing and tracking proof of the purchase order placed directly with the First Sale manufacturer and proof that the product is destined for exportation, with supporting documents. The First Sale initiation process can appear daunting, yet having a verified trade compliance partner in place and the proper technical and legal infrastructure established, the practice opens an opportunity of significant savings for the importers who choose to take the path.